The cash cycle, also known as the cash conversion cycle (CCC) or the net operating cycle, is a metric showing how long a business takes to convert its inventory into cash. It is the time between when you spend cash on inventory and when you receive payments after selling the items. The whole process involves purchasing materials, converting them into stock, and back into cash via sales as defined by a specific time period, such as the number of weeks or days.

'Cash is king' is a popular adage. But the maxim rings even more true in eCommerce businesses where the cash cycle can impact the business's bottom line. Read on to learn more about the eCommerce cash cycle and how to develop a good one.

The Reasons Behind the Long Cash Cycle in E-commerce

There are two main reasons why eCommerce businesses have a long cash cycle.

Brand owners have to purchase inventory before they can sell it

One reason behind the long cash cycle in eCommerce is the long time it takes to receive your cash back while it is tied up in inventory. Ecommerce owners have to purchase relatively large runs of products and often don't have the negotiating power to pay suppliers and factories at a later date. Therefore, they have to fund the inventory purchases before the sales channel, such as Amazon, pays them back for the units sold.

The typical sales channel payout schedule

The typical payout schedule of sales channels is another reason why eCommerce has an extended cash cycle. WalMart seller disbursements can be as long as 14 days, while Amazon can be even longer, depending on several factors. In short, waiting to receive your payments while you have to pay early puts pressure on the cash flow, making the cash cycle long.

Related: The Best Tips for New Sellers on Amazon

https://youtu.be/uvmZx4aodnY

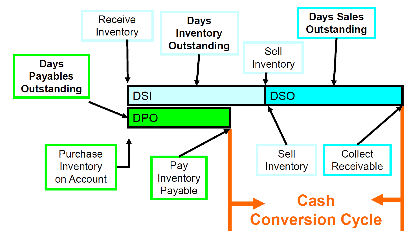

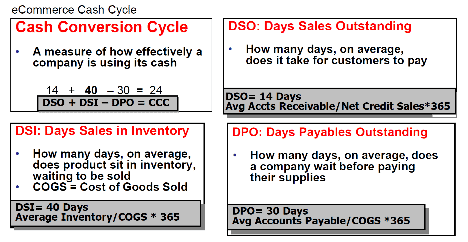

How To Calculate the Ecommerce Cash Cycle

The cash cycle has three components; Days Inventory Outstanding (DIO), Days Sales Outstanding (DSO), and Days Payables Outstanding (DPO). You obtain the cash cycle by subtracting the days' payables outstanding from the sum of days inventory outstanding and day sales outstanding.

Since the cash cycle of a business moves through three different stages, you must have certain records from your eCommerce business's financial statements to calculate the cash cycle. These include:

- Opening accounts receivables, accounts payables, and inventory

- Closing accounts receivables, accounts payables, and inventory

- Cost of goods sold (COGS) over the period

- Number of days that comprise the period

The records are for the specific period you wish to calculate, e.g., annual (365 days) or quarterly (90 days).

Days Inventory Outstanding (DIO)

DIO is the average number of days before the eCommerce business sells the existing inventory. Any eCommerce business would prefer a low DIO as it means the stock on hand sells quickly. DIO reveals the following crucial insights about a business's inventory management policy.

A high DIO could mean the inventory management is inefficient, while a low DIO means the business generates quick cash flow that can help meet its short-term payment obligations.

Also, a high DIO could mean you have the wrong target market for the product, insufficient demand, or even unreasonable pricing. It could also be a sign of an inventory that is becoming obsolete. The eCommerce business would need to introduce new strategies such as bundling to sell off the products quickly.

On the other hand, a low DIO could mean that the inventory levels are reaching zero, and your business is losing out business opportunities to competitors.

DIO = (Average Inventory / Cost of Goods Sold) X Number of the days in the period

Average Inventory = (opening inventory + closing inventory)/2.

Cost of Goods Sold (COGS) refers to the direct cost of acquiring or producing goods and services that a company sells during a given period.

COGS = opening inventory + purchases (during the period) – closing inventory.

Days Sales Outstanding (DSO)

DSO or days receivables or average collection period refers to how fast credit sales can turn into cash. This metric measures the average number of days it takes for an eCommerce business to collect payments from customers for the sales made during a given period. Ideally, your DSO should be low because that means the business is receiving cash quickly and can inject it back into the business. A high DSO means there are delays in payment collection.

DSO = (Accounts Receivable/Total Credit Sales) x Number of days in the period

Days Payables Outstanding (DPO)

DPO is the period it takes for an eCommerce business to pay its short-term obligations, including financiers to suppliers. This metric reveals the efficiency of a business's payment policy. Any eCommerce business would prefer a high DPO as it means there is money available in the business for a long time which it can use to its advantage.

However, a consistently high DPO may insinuate that the business is not clearing its outstanding bills in time. This may strain your relationship with suppliers, and they may be less willing to supply items to the company on credit. The period between receiving bills and the funds actually going towards paying the outstanding suppliers is thus critical.

DPO = (Accounts Payables/ Cost of Goods Sold) x Number of Days

What is a Good Cash Cycle?

What is better between a high or low cash cycle? This question is popular with respect to the cash cycle. A lower cash cycle means less time gap between buying inventory, making sales, and receiving cash for an eCommerce company. It is preferred since a company has free cash flows to purchase more inventory, invest in marketing, etc. When frequent working capital is available, the company can buy more inventory, thus generating more sales and profits.

Therefore, the critical aspects of the eCommerce cash cycle are inventory management, payment collection, and bills payable. Any problem with one or more of these aspects would affect a business's cash flow.

A longer cash cycle, as is the case for eCommerce businesses, means it takes more time to turn an investment in inventory into cash.

Ways to Improve eCommerce Cash Cycle

Here's what you can do to improve your cash cycle:

Improve your relationship with your suppliers

Convince your suppliers to give you extra time to pay them. Even a single extra day of extended payment deadline can make a difference. You can sell the benefits of such a setup to your supplier by mentioning that they will get bigger and more consistent payouts. However, the approach will work if you demonstrate that your business is trustworthy. Therefore, you may need to develop a record of timely and full payments to reduce your risk profile in the supplier's eye.

Improve inventory management

Good inventory data allows you to hold just the right amount of stock. However, if you have an inaccurate system of measuring inventory, you may find yourself running out of stock or stuck with products that are not selling.

Seek ways to get paid faster

You can try reaching out to the sales channels like Amazon and request more frequent payouts. You can also negotiate shorter period payouts, for instance, 30 days from your wholesalers instead of waiting two whole months to get your money back. Sometimes, the alternative would be to do a deep dive into your sales and quit selling on sales channels that take forever to pay.

Find a funding partner aligned with sales

If all the strategies mentioned above do not work or lead to some other disadvantages such as reducing your sales, you have another great option. Generally, you want to have inventory sufficient for your high sales volume. You also want to extend accounts payable as long as possible so you can retain more cash flow. While you may consider banks or funding tools, most of them may do your eCommerce business more harm than good because they charge very high interests and fees.

However, you can find a partner who is aligned with sales so you can get your money within days and repay it as soon as you sell a product. Actually, the partner can integrate with your store and bank (via a read-only API) to deposit and debit your account automatically so you never have to make a physical payment. That would mean a healthier cash flow to buy more inventory or invest in marketing.

Related: Financing ECommerce Tips for Small Businesses

The Benefits of a Strong Cash Cycle

When you optimize your eCommerce cash cycle, you'll enjoy benefits such as:

Lower opportunity cost

You miss more opportunities if your funds are tied up in stale inventory for long. That means, most of the time, you can't increase inventory in time to generate more profits. But when you have a lower cash cycle, you can take more initiatives to grow your business.

High customer satisfaction

Running out of stock because your funds are tied-up is frustrating. But it is even more frustrating when customers visit your eCommerce store only to find that the product they want is out of stock. When you keep tabs on your cash cycle, your orders keep flowing, your product ranks high, and customers are happy.

Competitive advantage

A lower cash cycle gives you quick access to capital that can help expand your business horizons faster. Having more cash at your disposal can also help give your business an upper hand since you can access opportunities your competitors may not.

Build an eCommerce Cash Cycle that Helps You Win

A strong cash cycle is a key growth lever for your eCommerce company. However, eCommerce business owners face challenges creating or maintaining a healthy cash cycle, especially because they are keeping up with the industry's fast pace and juggling a lot.

Onramp recognizes this challenge and develops cash flow solutions for eCommerce sellers. With over a decade of assisting business owners in navigating eCommerce challenges, Onramp will help you solve problems and reach your full potential.

Our funding is 100% aligned with your sales and repayment, and fees are responsive to actual performance. Our fees are incredibly low, and our funds have no interest. Furthermore, you pay back your advance only when your inventory sells. You repay faster when sales are up, but when the sales take a dip on a slow month, we collect less, thus helping you protect your cash flow.

Contact us for more information.